4 Spring Activities for Oil & Gas

Posted on April 9 at 12:35pm

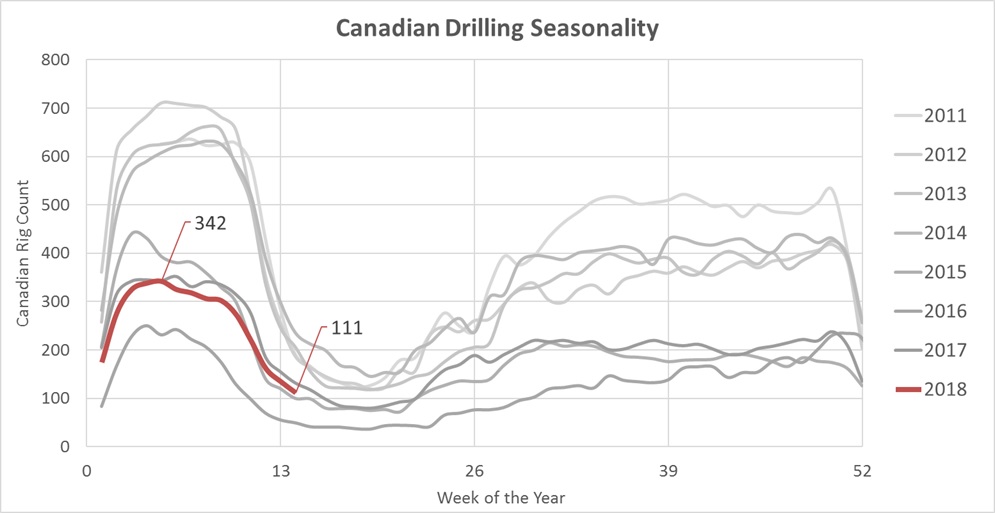

Canadian rig count fell 23 this week to 111, now 68% below the season high of 342 rigs. The decline in rigs is a normal part of the winter drilling season, as the snow melts (or "breaks up") and Spring Breakup begins. During this time, the industry shifts its focus towards completing the wells that were drilled and bringing them onto production. But just because drilling activity slows down, drilling departments have more than enough to keep them busy.

It’s like the Olympics, the NFL, NHL, NBA and every other sport. “Game time” is a fraction of the year, and the majority of the year is spent “off-season” by training, planning ahead and running background operations like trades and drafts. Success depends on more than just the execution, but on all of the planning in the background too.

So while we wait for Spring Breakup to end, here are 4 ways companies can spend their time to plan for success and hit the ground running when drilling picks up this May.

#1) Find Out Where You Perform Best (and Where You Don’t)

Connected datasets and historical information can be used to create a picture of where you’re performing well and where you can be more efficient. But having data isn’t enough to create the right picture. It’s crucial to have the right benchmarks, but some benchmarks are better suited to specific goals than others, so it’s equally as important to have the right goals.

In drilling, that means if the goal is cost reduction, then focus on total operating days and average daily cost. If the goal is consistency and efficiency, then focus on average drilling speed and the fraction of time actually spent drilling.

There are a vast number of benchmarks to use, so carefully select a few to focus your improvement efforts on. Once you have clear goals and a better understanding of your operations, you are equipped to execute on your initiatives more effectively.

#2) Compare Actuals To the Plan

There is always a plan before execution. Budgets are set the previous year, wells are designed months before drilling, and daily operations are reviewed every morning. After every plan is an opportunity to capture data from the actual outcome. The variance between that plan and the reality helps improve the processes, models and experience for future planning.

Closing the gap between the plan and reality helps companies develop more reliable expectations for the future, so they can confidently pursue new opportunities with known risks.

#3) Learn About Your Peers

With a clear view of your own performance, you’re able to compare yourself to others and identify your gaps from top performers.

Let’s look at an example using drilling speed, measured in meters per Operating Day. Based Unsist Energy Data, the gap between the top 10% and the average is 18%. So, if we assume well costs are time based, then a top performer may save over $360,000 on an average well that costs $2,000,000 to drill.

Similar heuristics can be applied to other aspects of the energy sector, such as completions and production. Once the performance gap is identified, the next step is to take action.

#4) Identify Opportunities to Improve

The benefit of identifying the gaps is that it quantifies the opportunity for the business, which can be factored into a calculation of ROI (return on investment) to prioritize which opportunities to pursue.

Based on potential savings of $360,000 per well (previous example), a company may be able to justify modifying aspects of the drilling program such as the well trajectory, BHA design, mud program or drilling rig equipment.

Ensure Your Own Success

Take advantage of the slower activity during Spring Breakup and spend more time to improve your business with data science. Use data to understand your internal performance, quantify gaps and identify improvement opportunities.

Because it won’t be long before Spring Breakup is over and nearly 100 additional rigs will be back at work. Take the time now to plan, and be ready for game time.